Compounding calculator math

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. Amount of money that you have available to invest initially.

Compounding Interest Rate Chart Interest Rate Chart Financial Charts Chart

The interest can be compounded annually semiannually quarterly monthly or daily.

. If your local bank offers a savings account with daily compounding 365 times per year what annual interest rate do you need to get to match the rate of return in your investment account. Free math lessons and math homework help from basic math to algebra geometry and beyond. B or Rate if Payments at the Beginning if the payments occur at the end of each period b 0.

The amount after n years A n is equal to the initial amount A 0 times one plus the annual interest rate r divided by the number of compounding periods in a year m raised to the power of m times n. The APY calculator can help you know how much interest you will get out of a bank balance or investment. So according to APY the bank is charging you 1268 interest yearly.

Students teachers parents and everyone can find solutions to their math problems instantly. Consider for example compounding intervals. The calculator calculates the adjustment amount required for both the initial investment and the final value.

If you invest 1000 at an annual interest rate of 5 compounded continuously calculate the final amount you will have in the account after five years. A n is the amount after n years future value. With the most recent update this calculator can now perform either calculation.

The Compounding Formula is very like the formula for e as n approaches infinity just with an extra r the interest rate. The nominal interest rate is also called the base rate of a product. It indicates that bonds perform well when equities sell off.

Note that if you include additional deposits in your calculation they will be added at the end of. Compound interest is a great thing when you are earning it. The Investment Calculator can be used to calculate a specific parameter for an investment plan.

As APY takes into account the effect of the compounding factor the yearly rate is expressed as 101¹² - 1 01268. R nAP 1nt - 1 and R r100. If the payments occur at the beginning of each period b r.

The tabs represent the desired parameter to be found. Compound interest is when a bank pays interest on both the principal the original amount of moneyand the interest an account has already earned. You can either calculate daily interest for a single loan period or create a loan schedule made up of multiple periods each with their own time-frames principal adjustments and interest rates.

Its the basic advertised-everywhere not-including-compounding number-on-the-tin rate. Include additions contributions to the initial deposit or investment for a more detailed calculation. In the calculator above select Calculate Rate R.

For example to calculate the return rate needed to reach an investment goal with particular inputs click the Return Rate tab. N or Number of Periods is the number of periods of compounding and payments that occur. Math 520 Physics 432 Sports.

See How Finance Works for the compound interest formula or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding. Savings Calculator This one takes a lump sum of money and compounds it monthly over a fixed period of time at a fixed annual yield. E also appears in this most amazing equation.

Making regular additional deposits to your account has the potential to grow your balance much faster thanks to the power of compounding. Compounding intervals can easily be overlooked when making investment decisions. This finance calculator can be used to calculate the future value FV periodic payment PMT interest rate IY number of compounding periods N and PV Present Value.

Time of investment and compounding interests. The calculator will use the equations. If youd like to know how to estimate compound interest see the article.

The APY rate is the figure that includes compounding. In finance a negative correlation or an inverse relationship occurs between investment returns of 2 different assets. A good example is negative correlation between equities and bonds.

E i π 1 0. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to. PMT or Payment is the regular payment each compounding period.

Want to see how much you interest you can earn. All the user need do is provide the goal ROI and click Calc to update. Plus it allows you to add.

Years at a given interest rate. Thought to have. A 0 is the initial amount present value.

You can enter either within our calculator indeed our calculator will work out the APY rate for you if you enter the nominal rate. However it is important to understand the effects of changing just one variable. By using the Compound Interest Calculator you can compare two completely different investments.

See how much you can save in 5 10 15 25 etc. Read Continuous Compounding for more. Compound interest calculator online.

Each of the following tabs represents the parameters to be calculated. When we chose an interest rate of 100 1 as a decimal the formulas became the same. R is the nominal annual interest.

This Daily Interest Loan Calculator will help you to quickly calculate either simple or compounding interest for a specified period of time. Our daily compounding calculator allows you to include either daily or monthly deposits to your calculation. In the formula A represents the final amount in the account after t years compounded n times at interest rate r.

To calculate compound interest use the formula below. Look at these two investments. It also calculates the absolute amount for both.

You can calculate based on daily monthly or yearly. This compounding interest calculator shows how compounding can boost your savings over time. Eulers Formula for Complex Numbers.

Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate.

Finding Interest Rate And Time In Compound Interest Compound Interest Accounting Basics Life Hacks For School

Ready To Use Compound Interest Calculator Template Msofficegeek In 2022 Interest Calculator Financial Analysis Rule Of 72

Interest Calculator Simple Vs Compound Interest Calculator Interest Calculator Financial Tips Financial

Calculating Periodic Interest Rate In Excel When Payment Periods And Compounding Periods Are Different Interest Rates Excel Period

Expanding Compound Interest Equation To Find R Excel Formula Intrest Rate Compound Interest

Compound Interest Formula And Compound Interest Financial Quotes Formula

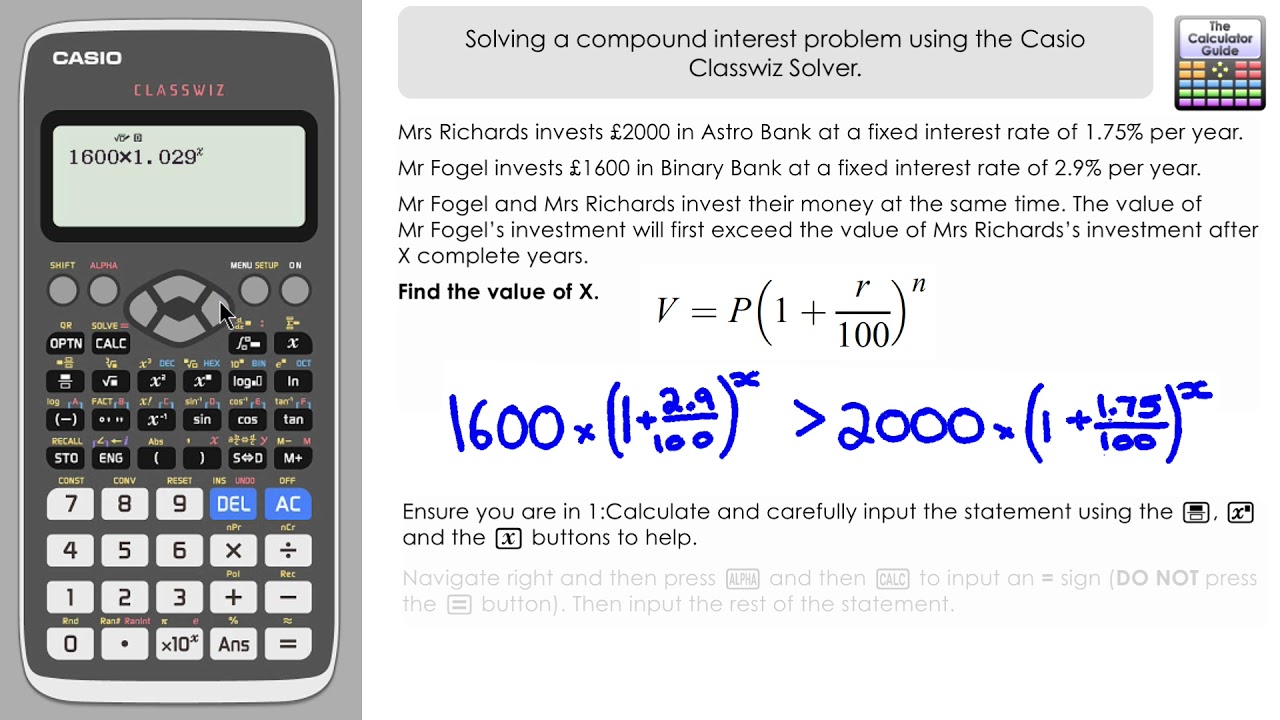

Compound Interest Problem Solving On Casio Classwiz Calculator Fx 991ex Calculator Problem Solving Solving

Compounding Interest Word Problem Math Notes Word Problems Homeschool Math

How To Calculate Compound Interest Formula With Examples Math Formula Chart Compound Interest Math Homework Help

Calculate Compound Interest Formula With Examples And Practice Problems How The Formula Works đầu Tư Einstein Sức Mạnh

Compound Interest Formulas Calculator Interest Calculator Compound Interest Compound Interest Math

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Money Quotes Business Savvy

Savings Withdrawal Calculator Interest Calculator Calculator Savings Calculator

Formula For How To Calculate Compound Interest Interest Calculator Compound Interest Math Formulas

How To Calculate Compound Interest 15 Steps With Pictures Compound Interest Interest Calculator Simple Interest

Compound Interest Calculating Tool Compound Interest Interest Calculator Compounds

Compound Interest Calculator Investor Gov Interest Calculator Compound Interest Calculator